19+ Mortgage protection

Second mortgages come in two main forms home equity loans and home equity lines of credit. VA USDA loans.

2

Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages.

. Youre an important part of the rental economy. Loan servicers are also impacted by the pandemic so may be working with staffing and technology. Each three-month extension must be individually requested.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. The Bureau of Consumer Financial Protection Bureau is issuing this final rule to amend Regulation X to assist mortgage borrowers affected by the COVID-19 emergency. Were the Consumer Financial Protection Bureau CFPB a US.

Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially granted. 13 The priority of competing interests. Annual mortgage insurance premium MIP costs 085 of the loan amount per year split up into 12 installments and paid monthly with the mortgage payment.

Avoid foreclosure and mortgage scams with these four steps. A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages. 2601 et seq that is secured by the consumers dwelling the creditor shall provide the consumer with good faith estimates of the disclosures required by 102618 and shall deliver or place.

Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. Domestic Violence Survivors. SBAs table of small business size standards helps small businesses assess their business size.

The rent relief program re-authorized in AB 832 pays 100 percent of. Learn how to recover back rent and find out about mortgage forbearance for your property if you are a landlord. Servicemembers can pause a court eviction If you are pursuing an eviction in.

Learn what you can do if you have trouble paying your mortgage. Rethinking the approach to regulations JUN 17 2022. Mortgage servicers generally cannot ask for proof of hardship.

PNC COVID-19 Protective Measures. Know why your mortgage payment might change. RCW 19105405 19105500.

Information about COVID-19 from the White House Coronavirus Task Force in conjunction with CDC HHS and other agency stakeholders. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

The gov means its official. Servicemembers and their dependents have eviction protection rights. Bail bond agents Records Finances Disposition of security Application of consumer protection act.

Before sharing sensitive information make sure youre on a federal government site. If you can pay your mortgage pay your mortgage. View more For professionals We have resources for mortgage real estate settlement and housing counseling.

You do not need to pay for help with forbearance. If you cant pay mortgage or can only pay a portion contact your mortgage servicer immediately. Gavin Newsom on June 28 2021 signed legislation that expands and extends the CA COVID-19 Rent Relief program designed to provide financial relief to renters and landlords with unpaid rental debt because of the pandemic.

Mortgage loan basics Basic concepts and legal regulation. The Coronavirus Aid Relief and Economic Security CARES Act was a 22 trillion package of emergency assistance approved in 2020 in response to COVID-19. The latest public health and safety information for United States consumers and the medical and health provider community on COVID-19.

Food Stamps and Meal Programs During the COVID-19 Pandemic. If you requested your initial COVID-19 Forbearance Plan between July 1 2020 and September 30 2020 you may request up to one additional three-month extension. If you have a federally backed loan the mortgage servicer is not permitted to ask you for proof of hardship.

The COVID-19 Forbearance extension periods may not extend beyond December 31. Business opportunity fraud act. Centers for Disease Control and Prevention.

54 Paycheck Protection Program Funds Exhausted. 114 Be on Alert for Vaccine-Related Scams. You may need to stay on the phone for a while before the servicer is able to take your call.

Keep in mind that a federal regulation promulgated under the Real Estate Settlement Procedures Act prohibits most mortgage servicers from taking the first step to initiate a judicial or non-judicial foreclosure under any state law until at least 120 days have passed since the. The reason why third-party interests require protection. The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buyBonds securitizing mortgages are usually.

Home insurance also commonly called homeowners insurance often abbreviated in the US real estate industry as HOI is a type of property insurance that covers a private residenceIt is an insurance policy that combines various personal insurance protections which can include losses occurring to ones home its contents loss of use additional living expenses or loss of. We reviewed and compared the plans dispute types and prices of the best credit repair companies. COVID-19.

Because of the COVID-19 pandemic it may be easier for you and your family to get food stamps and take part in meal programs. 11 Notices and restrictions. Renter Landlord COVID-19 Relief Program Extended.

12 Matters not covered by this guide. Explore forbearance to pause your mortgage payments. Use our list to find help rebuilding your credit.

Your mortgage payment may change for a few reasons for example you have an adjustable rate mortgage and the interest rate changed. You can ask for forbearance and tell your servicer that you are going through a financial hardship because of the pandemic. Federal government websites often end in gov or mil.

In a reverse mortgage transaction subject to both 102633 and the Real Estate Settlement Procedures Act 12 USC. The COVID-19 pandemic has caused money struggles for both renters and landlords. Government agency that makes sure banks lenders and other financial companies treat you fairly.

Second mortgage types Lump sum. The final rule establishes temporarily procedural safeguards to help ensure that borrowers have a meaningful opportunity to be reviewed for loss mitigation before the servicer can. Following guidance from the Centers for Disease Control and Prevention CDC we continually adjust our cleaning frequency and protocols to conform with the CDCs updated recommendations.

A Mortgage transactions subject to RESPA 1 i Time of disclosures.

Eyad Kutkut Mortgage Advisor Lendem Financial Llc Linkedin

Covid 19 Marvin Lim For Ga

How To Choose 529 Plans For Your Child S Education Moneygeek Com

Covid 19 Marvin Lim For Ga

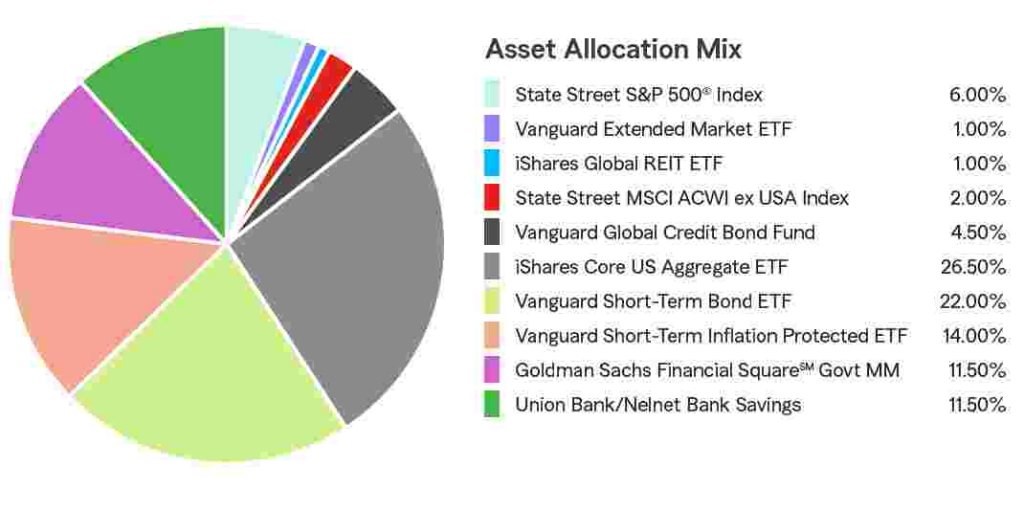

State Farm 529 Savings Plan Age Based 19 Plus Portfolio State Farm

2

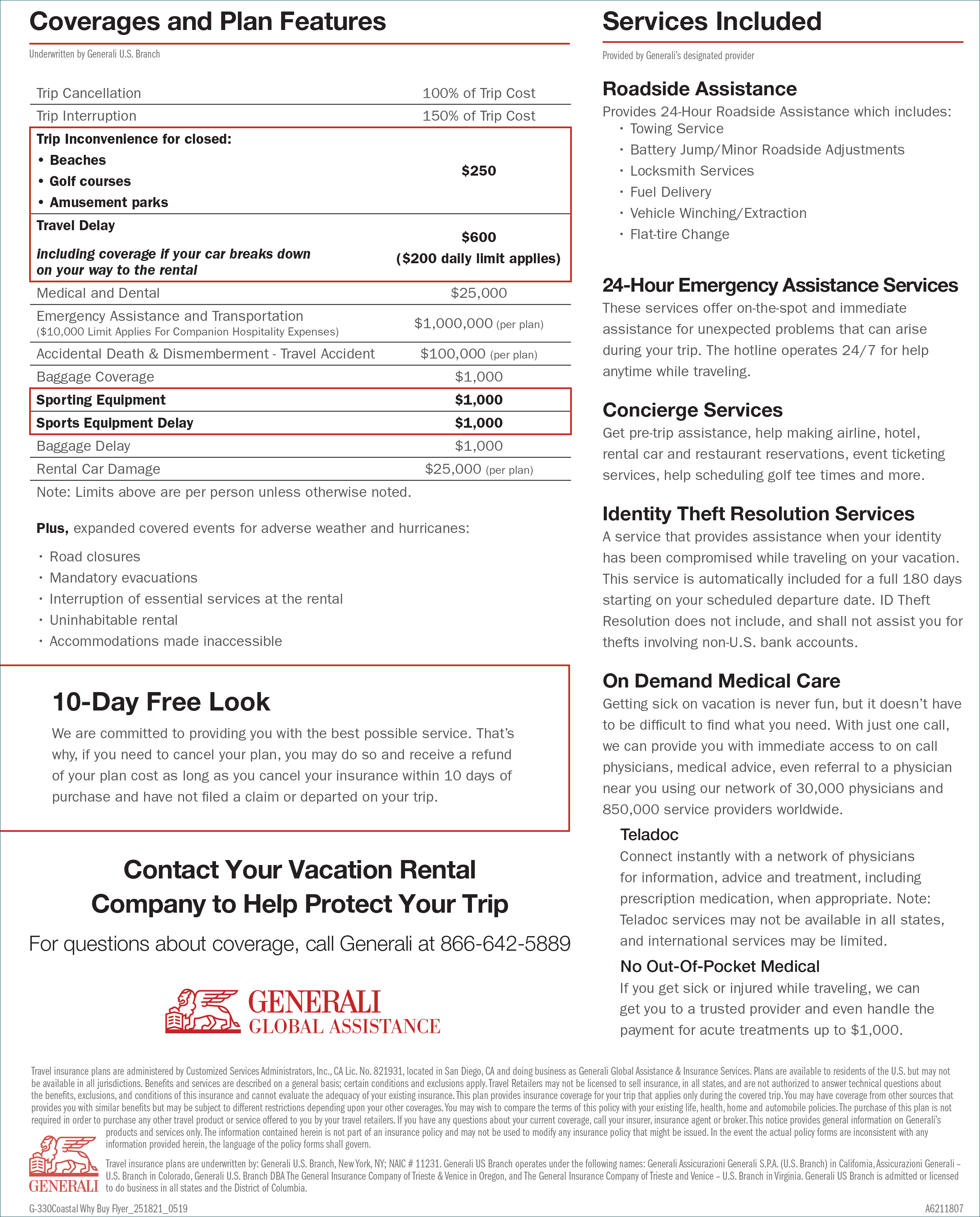

Seaside Coastal Travel Insurance Bryant Real Estate

Seaside Coastal Travel Insurance Bryant Real Estate

![]()

Premium Vector Insurance Services Concept With Flat Icons For Poster Web Site Advertising Like House Car Medical Travel And Family Insurance In Hand Isolated Vector Illustration

2

2

When Should You Get Life Insurance

Premium Vector Home Insurance Policy Services Home Safety Security Vector Stock Illustration

2

Eyad Kutkut Mortgage Advisor Lendem Financial Llc Linkedin

2

Mortgage Broker E O Professional Liability Insurance